Aegon Life Insurance which was earlier known as Aegon Religare Life Insurance Company Limited is one of the very popular online insurance companies; launched in July 2008. Aegon, an international life-insurance provider tied up with Bennett, Coleman & Company to launch Aegon Life Insurance. The have setup their headquarters in Mumbai serving around 4.4 lakh customers in India. Recently, they re-launched their flagship product offering comprehensive online protection, Aegon Life Insurance iTerm Online Protection Plan. It is cost effective and provided on of the cheapest premium rates in the industry.

As per a Swiss Report, Aegon felt the need to launch iTerm to show the superficial state of insurance in India and the large percentage of underinsurance even in families who do have insurance. Not only this, but their report also mentions that India is a country that has much more protection margin as the development in savings and life coverage has failed to keep up in pace to economic and wage growth. There has been a great amount of growth recently in insurance penetration, but that did not help to meet protection needs of the population. It is still stands at less than 10% of the population’s protection needs. Pure protection insurance and term products are very less popular amongst the consumers. Adding to it, the inability to reach a wider range of consumers, the gap only increases.

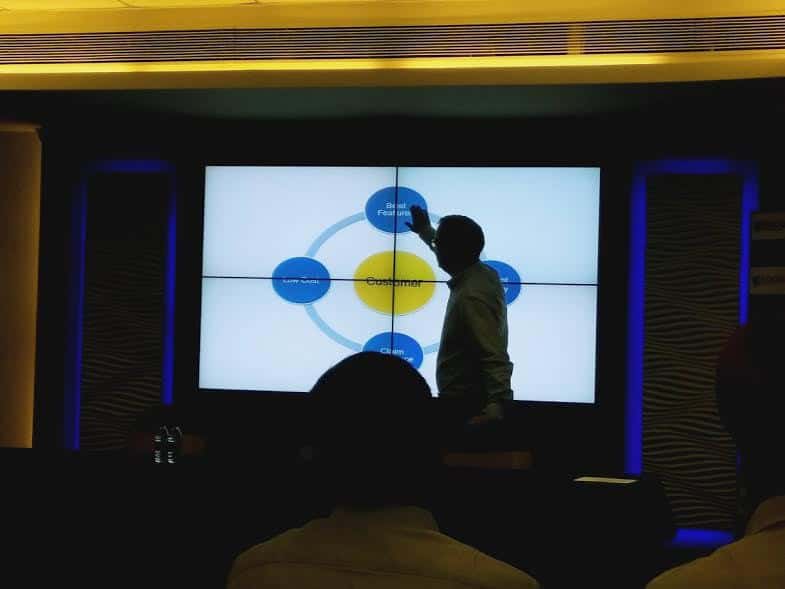

Aegon is one of the customer centric companies, and being what it is, a protection plan that grows to cover bigger life responsibilities was much needed. iTerm Online Insurance Plan was re-launched because of this belief. To get an unmatched combination of convenience, value, and simplicity, customers have to reach online, as iTerm is only available online. In addition to financial security, iTerm also provides optional coverage through riders.

Mr. Martijn De Jong, the Chief Digital Officer also spoke on this occasion, he said, “Our idea is to engage every consumer who can be a part of iTerm. With a focus on protection, delighted to introduce iTerm which is best-in-class product suite that will cater to today’s consumer needs.”

He further added, “Our main focus for every consumer is protection. Every family is important for every individual. iTerm which comes will every technological and innovative benefits, will be an ideal choice for every household”.

New & Advanced features of iTerm Online Protection Plan:

- A plan that is available online is comprehensive protection plan and most cost effective.

- Customers are provided with additional Life stage benefit. In important milestones in life, it enables customers to increase their protection cover.

- The previous plan allowed customers to make annual payments, whereas now it has given the liberty to the customers to pay on a monthly, half-yearly, and annually.

- The maturity age and maximum policy term are raised to 80 years and 62 years, respectively.

- Death benefit payout can now be filed as a lump-sum payment/ fixed monthly income for 100 months/combination of the above.

Other features of iTerm Online Protection Plan are:

- Minimum and maximum ages for a customer for entry are 18 years and 65 years, respectively. With minimum and maximum policy term of 5 years and 62 years, respectively.

- Terminal Illness benefit is Inbuilt.

- Critical illness, Disability, Accidental death and Women specific Critical illness is added with the additional optional coverage (riders) option in against.

- Non-smokers and Females will be rewarded with Lower premium rates.

- As per prevailing tax laws, benefits received and premium paid have tax benefits.

- Starting from 25 lakh and ending at no maximum limit, Total Sum Assured is subject to underwriting.

To allow consumers to make their plan more comprehensive, iTerm also includes riders as an important feature.

Some of the Riders of iTerm Online Protection Plan:

- Aegon Life AD Rider – In any case if a person having Life Insurance died an accidental death, the Sum will be paid as assured.

- Aegon Life ICI Rider – In a case of Cancer, Open Chest CABG, Stroke & First Heart Attack the sum will be paid as assured under this rider.

- Aegon Life WOP Rider on CI – In case a person is diagnosed with this 4 illness, which are First Heart Attack, Open Chest CABG, Stroke, and Cancer, future premiums payable as per the base plan are waived, continuing the life cover.

- Aegon Life Women CI Rider – Illness that women pertain are covered under this rider. It is divided into 2 groups. 1st consist of Malignant Cancer of Female Organs and 2nd is for Pregnancy Complications and Birth of the child with Congenital Disorders.

- Aegon Life Disability Rider – In a case of permanent disability of the Life, this rider offers an immediate lump sum payout along with the waiver of future outstanding premiums of the base plan.

These riders can be attached to a base plan on policy commencement or at any time during the term of the base plan.