On the night of November 8th, 2016, Indian Prime Minister Shri. Narendra Modi announced that Rs. 500 & Rs. 1000 notes won’t stand as a legal tender starting November 9, 2016. Initially, the fight against black money & fake currency were the core reasons, as understood. However, it slowly moved towards one big goal – Cashless Economy. India is gradually moving towards becoming a Cashless Economy. The use of Digital Payment Wallets is on the rise. Amid the race of Digital Payment Wallets running to gain the top stop, there is, PhonePe – India’s Payment App supporting Unified Payment interface (UPI).

Powered by Yes Bank, PhonePe was acquired by Flipkart in April 2016 & was launched as its UPI-based mobile wallet on August 29th, 2016. PhonePe offers services like bill payments, DTH recharges, mobile recharges and peer-to-peer money transfers, etc. However, PhonePe is equipped with a few fantastic features and stands ahead of other digital payment wallets.

USP of PhonePe App Digital Wallet:

PhonePe is a digital payment application, one of the best ones built for Android smartphones on United Payments Interface (UPI), which allows you to connect your bank account to the app and use it for digital payments. The following USP’s make PhonePe stand out among other digital wallet apps:

- The only wallet to enable users making direct & secure bank-to-bank transfers using the recipient’s registered mobile number only. No need to enter the bank details such as IFSC code or account number of the recipient separately.

- PhonePe is the most secure digital payment platform in the country as it uses MPIN (similar to ATM pin) for all transactions.

PhonePe Digital Wallet – Getting Started:

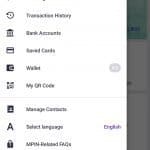

- Select your preferred language

- Send an SMS to verify your mobile number securely

- Activate your account

- Select your bank name

- Start paying

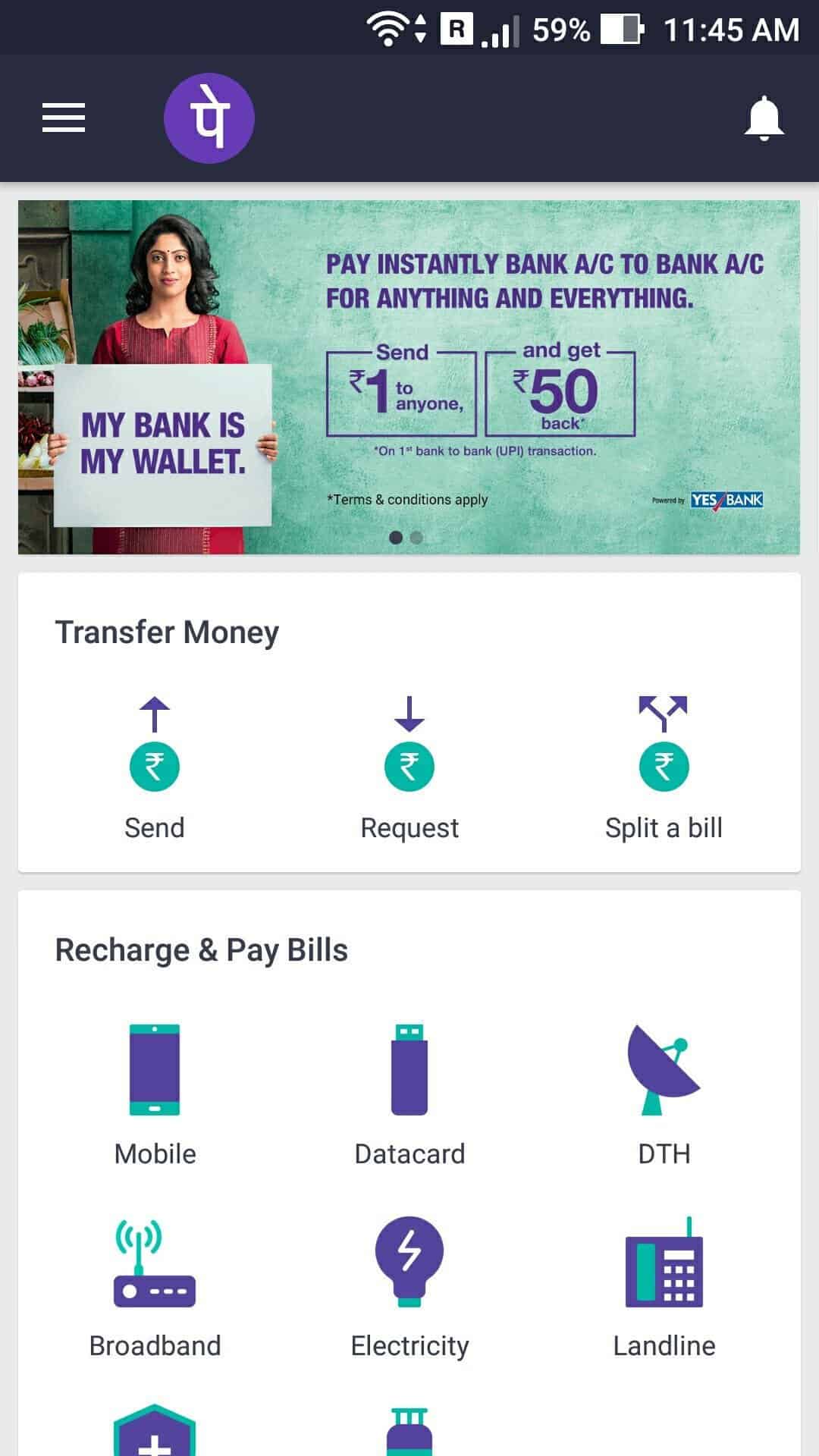

The primary features of PhonePe Digital Payment Wallet are –

- Person-to-person money transfers options via:

- Bank to bank transfer

- Wallet to Wallet transfers

- Own wallet to own bank transfer

- Payment feature for recharges & bill payments

- Pay at any store via UPI by Scanning the QR code

- Create a Virtual Payment Address (VPAS) to receive payments without sharing your mobile number

Once your PhonePe wallet is set up, you can add your bank account by just selecting the bank where you have your existing bank account.

[bs-quote quote=”It fetches your bank details with your registered mobile number. Yes!! It’s that simple.” style=”default” align=”center”][/bs-quote]While making any transactions for payments, you need to select the transaction you want to avail, the service provider & registration details of the service and enter the amount. Click on pay and enter your secured MPIN. That’s It! You have completed your payment.

To transfer payment to any other person, either select their mobile from your contact list or enter their bank account details or just enter their VPAS. You can also split your bills with the person having a PhonePe Digital Wallet using their registered mobile number or VPAS.

Benefits of PhonePe over other wallets:

- Unlike other digital wallets, you don’t need to pre-load money in your digital wallet. Every time you want to pay your bills or transfer money, just use UPI feature and use your linked bank account.

- PhonePe Digital Payment Wallet has the highest transaction limit among all digital wallets – up to Rs. 30,00,000 a month, which is usually Rs. 20000/month with other digital wallets such as PayTM.

- PhonePe is the only Digital Payment Wallet to offer the Zero Transaction Charges for a lifetime. All the wallets will have their regular fees back in place post-December 31st 2016.

Verdict:

After using PhonePe simultaneously with other Digital Payment Apps, I can confidently say that PhonePe excels the expectation and the app represent the sense of security with its bucket load of security features.